Last week, technology giants like Microsoft and Google have have unveiled deals with nuclear energy companies to power the energy-intensive data centres required to power artificial intelligence models. Google has announced that it would begin purchasing power generated by Kairos Power, whereas Amazon is investing around 500 million USD in the X-Energy Reactor Company.

This trend reflects the pressure on Big-Tech to power data centres amidst the surge of interest in generative AI. Researchers from the University of California have found that ChatGPT consumes a 16-oune bottle of water per 10-50 prompts. With about 200 million people submitting questions per week, it is no wonder Big-Tech is tapping on nuclear power.

Small Modular Reactors

These seemingly unconnected words have attracted Wall Street’s attention. As a result, shares of NuScale Power Corporation (SMR) have been trading 34% higher, exceeding analyst ratings.

NuScale Power Corporation is the first US SMR to market, engaging with the development and sale of modular light water reactor nuclear power plants for data centres and AI. In order to meet the energy needs, including AI applications), NuScale’s “Power Module” is capable of producing 77 megawatts of electricity.

The market is clearly welcoming the nuclear-power AI, though this movement will take time to gain traction because of regulatory reasons. NuScale Power Corp (SMR) is therefore going to become one of the many companies that long term investors embrace.

NuScale Power Corp (SMR)

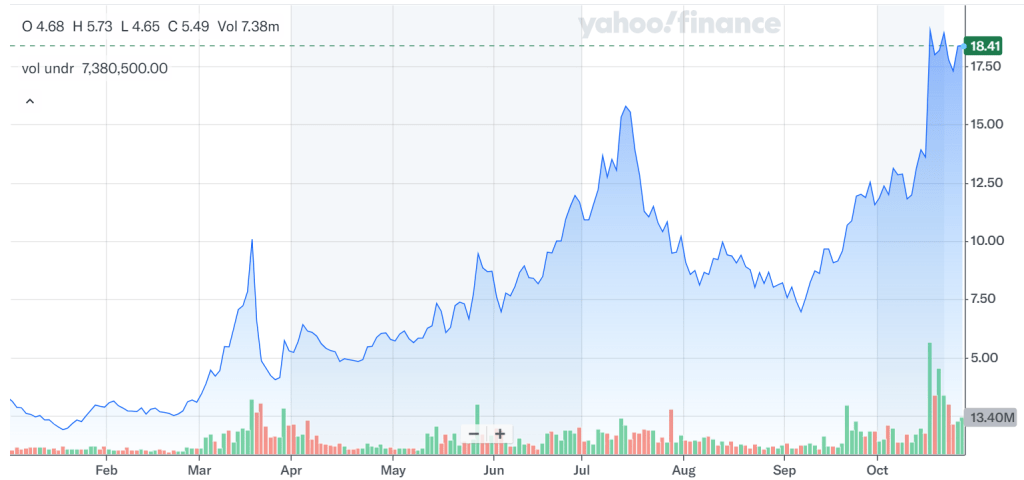

Shares of SMR are trading 460% higher than year-to-date at the time of writing. These shares are posting new all-time highs, with the average volume on the rise. As part of any developmental company, stocks are volatile. This has been reflected in the rough fourth quarter of 2023, owing to cost-cutting strategies being implemented.

With the stock breaking out of its sub-$10 pricing range, the world will begin taking more notice. The surge in prices now will lead to a short-term profit-taking scene. Prices of SMR will eventually drop as the first wave of speculative investors settle down, allowing investors to start picking up on this industry.

One response to “How AI is Leading a New Wave in Nuclear Energy?”

[…] an amazing dip opportunity for investors of NuScale Power. The stock has seen a strong bullish run over the past three months and the stock price is finally […]

LikeLike