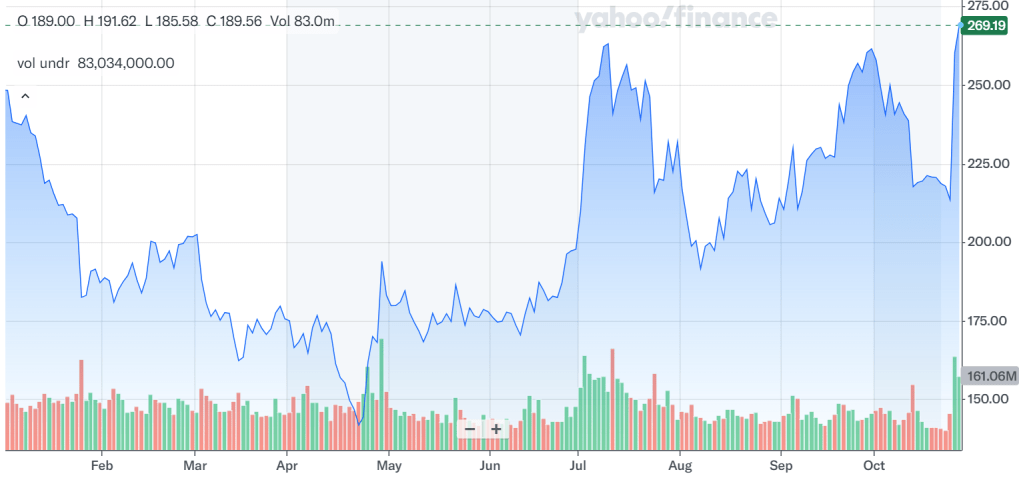

Tesla has had a rough time over the past year. This is a result of the challenging economic backdrop, caused by weakening demand from China and supply chain issues. Tesla shares hit a peak of $415 in November 2021, sliding down to $106 in 2022.

Tesla delivered good news to investors on October 23. Its strong third quarter results were reflected by the $2.17 billion in net income and earnings per share at 62 cents. This was largely a result of lower costs per vehicle and higher deliveries of its beleaguered Cybertruck.

Research carried out by BloombergNEF has concluded that EV sales is set to increase by 21% in 2024. This figure will only continue to increase alongside advancements in battery technology and decreases in costs. Furthermore, as countries move closer to their net zero targets, the demand for electric vehicles will only increase.

Tesla plans to launch more affordable models at the beginning of 2025. This move aims to help many potential buyers overcome the cost barrier. The company has agreed that its next period of growth will come from “advances in autonomy and the introduction of new products”.

Despite the optimistic view on the future, inflation and higher interest rates have caused a decline in sales. This is particularly true for high value items like EVs. Tesla has also faced increased competition in China as there is greater demand for the more affordable, domestic models.

In conclusion, Tesla has shown strong third-quarter results. Subsequently, Morningstar has increased their fair value estimate from $200 to $210 per share. With Tesla shares trading at about $245, Morningstar sees them as slightly overvalued at the moment.

Leave a comment