Investors of Apple are going through a quiet period as they await the earnings announcement that will be released on October 31st. Despite being the top seller of smartphones in 2023, analysts are starting to get concerned.

Apple shares have been downgraded to “Sell” by Brandon Nispel from KeyBanc Capital Markets, citing that “Apple has grown all product categories at the same time just 1 out of the past 10 years.” He has also dropped price targets to $200, showing quite a dip from Apple’s current trading price of $233.

Further drivers of these ratings are a result of Apple scaling back on the production of its newest product, the Vision Pro. iPhone orders in Q4 are also predicted to be reduced by around 10 million units. The recent downgrades by analysts therefore points to the high expectations towards Apple to produce strong results in the announcement later this week.

When should I invest?

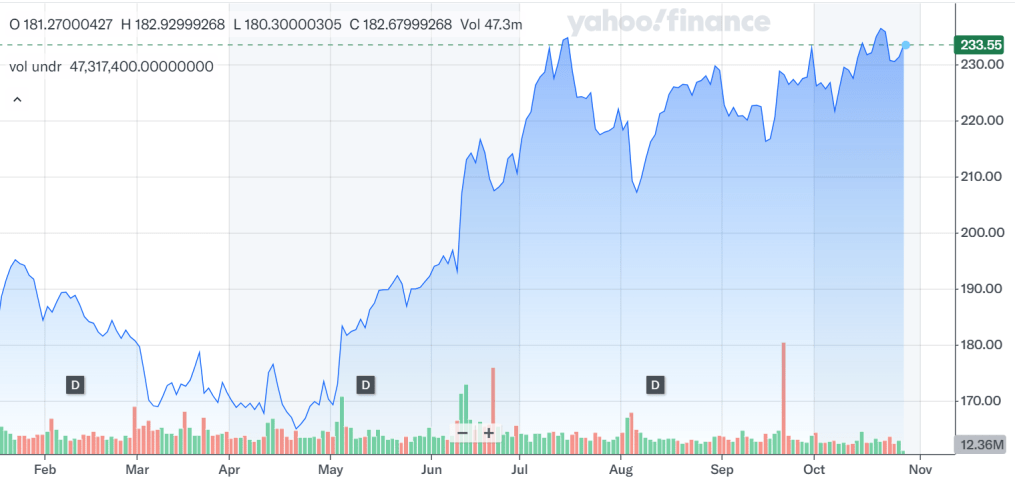

The bottom the company’s trading range has been $220 since July. This lack of trend has been a result of investor caution about its ability to bounce back. Therefore, if movement below this price level is observed later this week, increased selling of the stock would also be observed.

Hence, don’t buy any stocks until it reaches a $200 price level. Apple is not going away anytime soon, with the stock showing a bullish trend in the long-term. Buying shares at the price level mirroring the 200-day trendline would carry a good risk-reward ratio, should the earnings report not meet analyst expectations.

Leave a comment