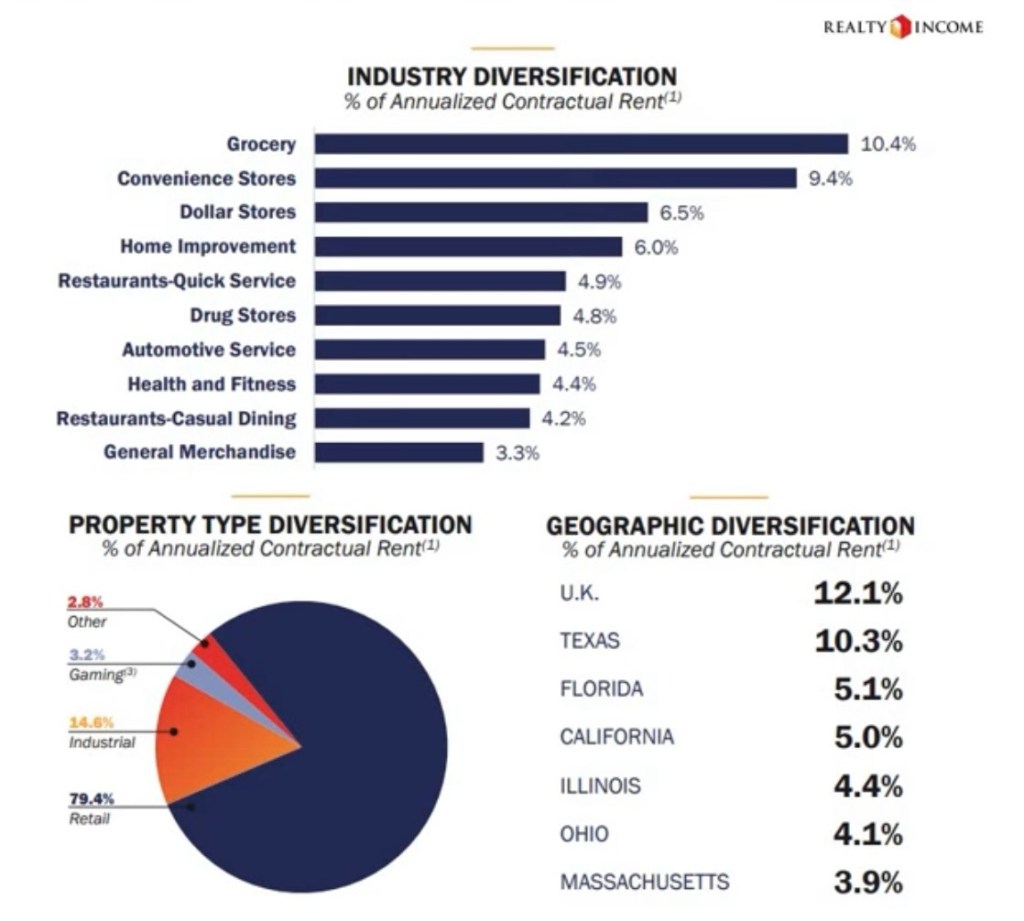

Realty Income (O) is a large net lease REIT, offering a healthy dividend yield of 5.6%. The company is large and well diversified, owning more than 15400 properties across 8 countries.

The company has proven to be financially strong – paying out dividends monthly for the past three decades consistently. The FFO (funds from operation) ratio sits at 75%, so a dividend cut anytime soon would be very unlikely.

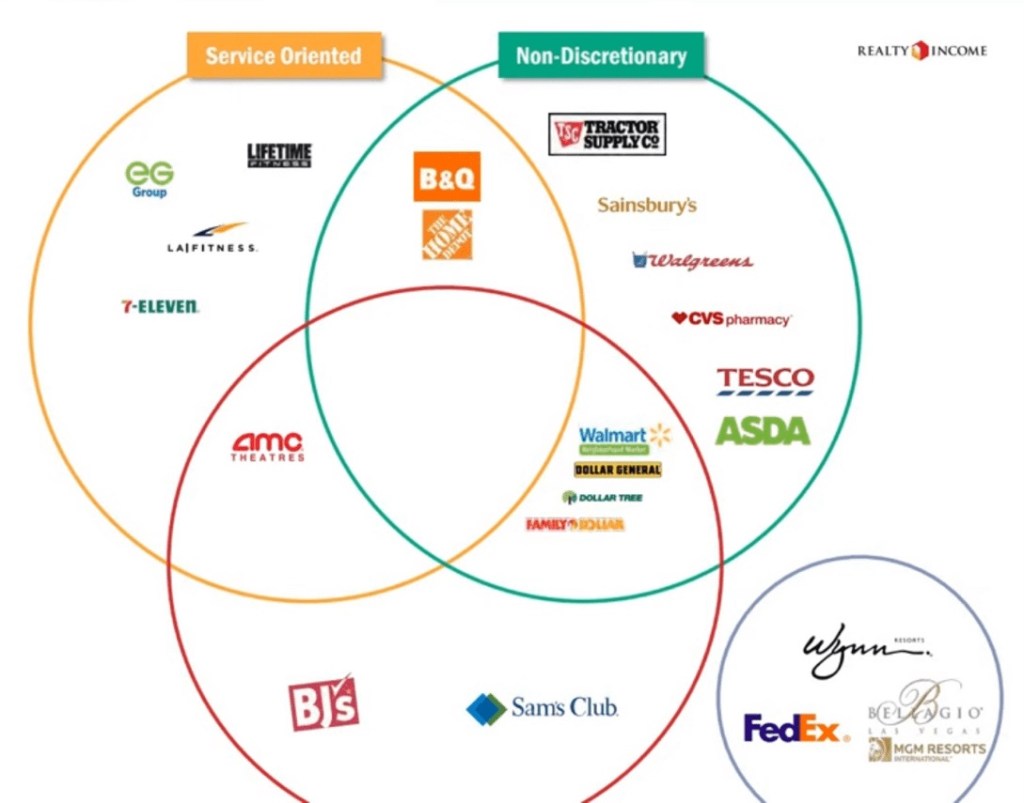

Highlights from the company’s report for the quarter are very promising. An additional $780 million was deployed on assets across Europe and the US, increasing the company’s diversification across the world. The occupancy rate of its assets are at a high of 98.7%, pointing to a steady stream of cash flow. The company has also highlighted the resistance of its top 20 clients to to changing customer behaviours, therefore will post steady growth in the future (see illustration below)

The biggest point of debate from the presidential election is about the resurgence of inflation. Shares of Realty Income will help mitigate this issue as rental rates will rise with the headline inflation.

Whilst the stock has underformed over the last couple of months, Wall Street Analysts are eyeing a double digit rally over the coming months. Therefore, it is a good time to start investing in the stock.

Leave a comment