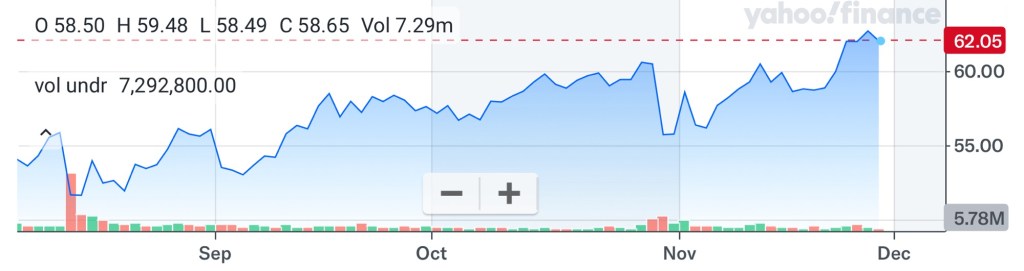

Chipotle ended the week strong with a 5% increase in its stock price, reaching its newest high since July. This surge in price came after the stock broke the $60 mark, attracting investment interest from institutional traders.

This shows good recover from the many challenges that Chipotle had to face. Earlier, the stock’s price tumbled by around 30% to the $50 mark after the company’s CEO left to join Starbucks.

Investors were happy with Chipotle’s strong earnings, shown in its Q3 reports. Chipotle also announced new, innovative additions to its menus. This has shifted investor sentiment to a more bullish stance, especially after the stock price overcame the 20, 50, and 200 day moving average.

Interim CEO Scott Boatwright has also highlighted the company’s goals during its third quarter reports. Long term targets includes the increase in store locations in North America to expand the company’s margins. Furthermore, the company aims to add another 300 locations to its fleet of American restaurants. With a robust balance sheet, high cash reserves and no debt, the company is a strong investment for the long term.

Leave a comment