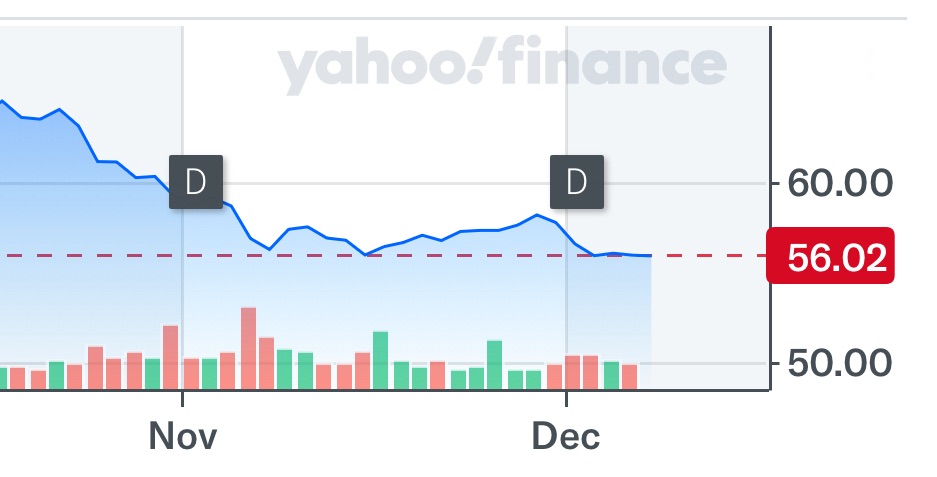

Shares of Realty Income are now trading 10% lower at around $57, a steep fall from the 52 week high of $64 that it reached on October 21. Realty Income stood out in the net lease sector following the decrease in interest rates. However, Donald Trump’s tariff impositions are unsettling investors.

Trump has proposed tariffs on imports from China, Mexico and Canada. This will hurt a proportion of Realty Income’s client base, especially those already struggling financially. Furthermore, many economists are pointing to the high inflationary pressure that would be seen with a Trump governement. The Central Bank would need to raise interest rates to combat the rise in inflation, which would negatively affect rate sensitive REITs.

Despite these negative headwinds, there are also many reasons to be positive about this stock. Realty Income has also been diversifying into non-traditional assets, acquiring assets such as data centers in a joint venture with Digital Realty. The cash flow it recieves from over 15500 properties across 50 regions in 7 countries also means that the company’s credit rating is strong.

Leave a comment