Shares of Nvidia have shed around 15% from November highs, shifting to a neutral buy rating. This move comes after press released about China launching an investigation into Nvidia over violating the country’s anti-monopoly laws.

Further headwinds are calling for investor concern. Microsoft’s demand for chips from the company is beginning to ease, with the CEO citing that the frenzy buying earlier was due to the increase in interest surrounding ChatGPT. Thus, demand for Nvidia’s chip might be lower in the near future. Furthermore, investors are engaging in profit taking runs ahead of the interest rate announcement.

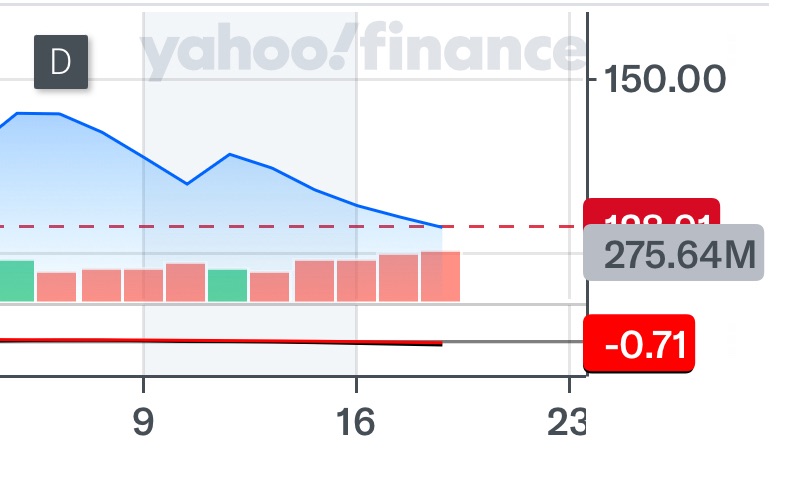

Despite dipping below the 50 day moving average, the stock remains well above the 200 day metric. The stock is bouncing against the critical support level of $130. A fall below this level will result in further dips to the 200-day moving average. However, these short term headwinds comes against a bullish long term price target of $200.

Leave a comment