The AI landscape has been changed dramatically following the release of DeepSeek; offering cheaper and more efficient LLMs that run on inferior chips. What this proves is that the most advanced chips aren’t necessary to produce AI models. One company I believe will benefit from this revolution is Palantir.

Palantir Technology

As the technology sector begins assesing the use cases for AI systems, Palantir is beginning to reap the benefits. The company specialises in breaking down large data points into usable information for other enterprises.

The company exceeded expectations in its earnings report; EPS sat at $0.03 above consesus estimates. Commercial revenue increased by a whopping 64%. This report displays the company’s robust business proposition.

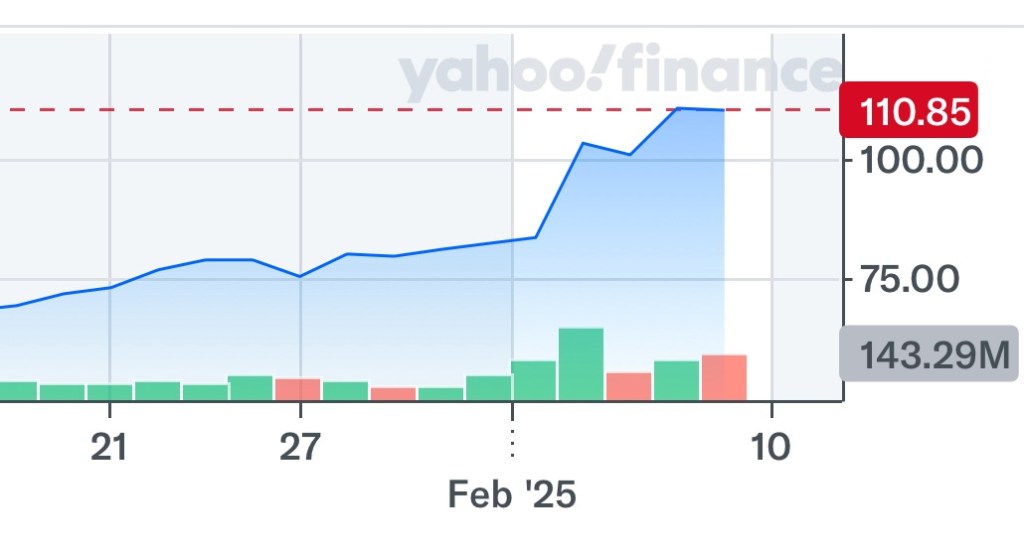

Share prices are now trading above $100 after surging by around 25% following the earnings report. Shares are now already up around 50% since 2025 began.

The stock is likely to consolidate at this price point before moving further upwards. The stock has a long term price target of $150.

Leave a comment