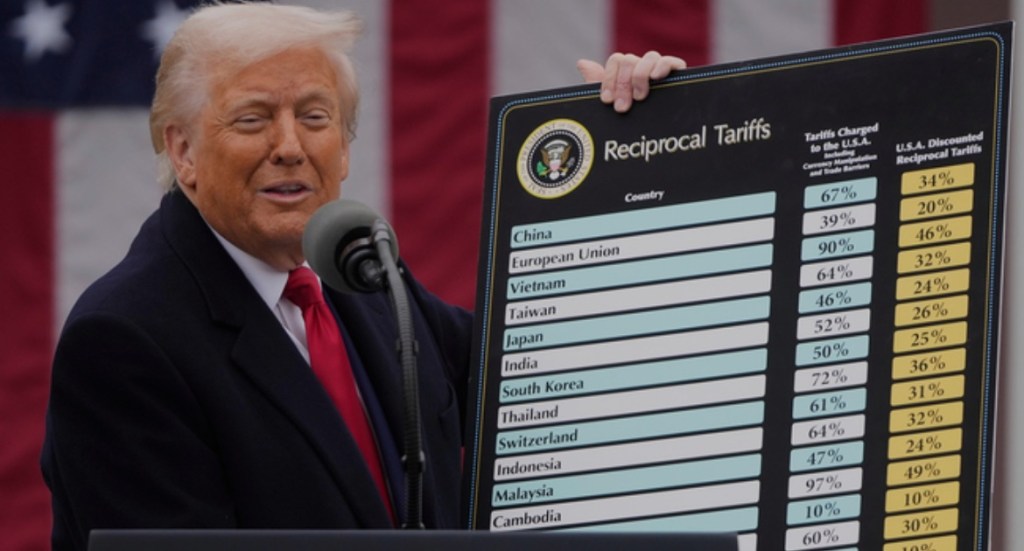

We are greeted by another sea of red today after China swiftly enacts 34% reciprocal tariffs on America. Major index funds, such as the S&P 500 and Nasdaq 100 are beginning to adopt bearish trends following these drops.

Whilst these major stock declines are partly a result of the extortionate tariffs, faults can also be seen on a fundamental level as we begin to enter the busy earnings season. There are more companies expecting negative EPS than positive, a stark difference to what was seen this time last year. Many more headwinds shrouds the markets. Inflationary pressures will only begin to materialise in the form of higher prices as the effects of tariffs hits the global population, further clamping down on consumer spending.

It is important to highlight the importance of patience during times like this. It would be wise to continue monitoring the market, especially as we approach earnings season and potentially see Trump open the negotiating table for tariffs.

Leave a comment