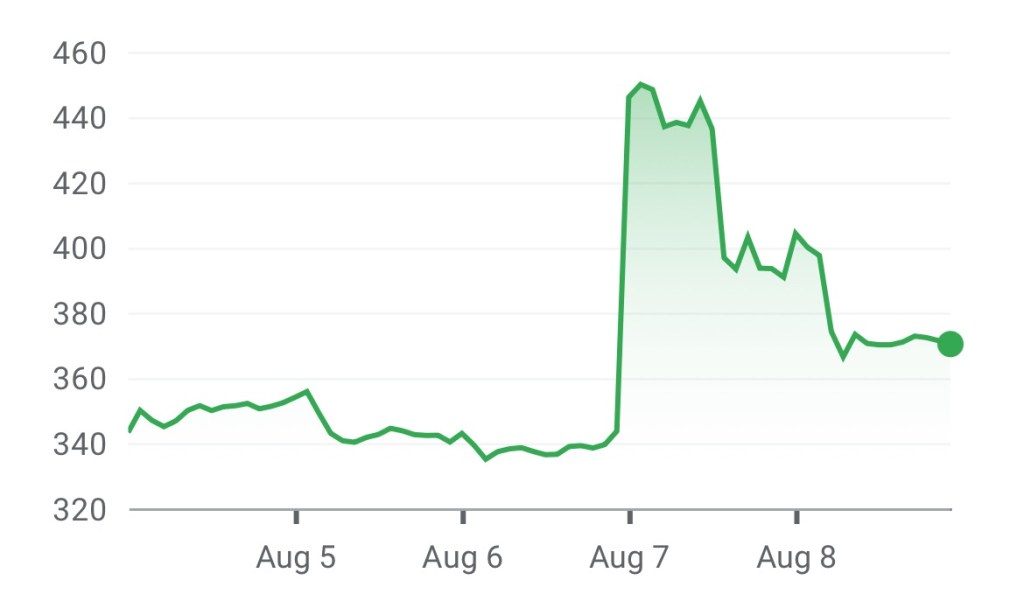

The 27% surge on August 7 sent shares up to a price of $450 after the stock began slipping back in May.

This rise has been catalysed by strong Q2 earnings. Revenue rose by 41% year-on-year whilst EPS exceeded estimates by $0.33. This positive growth has been reflected in the company’s daily active users, which rose 40%. Much of this success has come from Duolingo’s aggresive adoption of AI features, which has since replaced 10% of its workforce.

The following day (August 8), however, saw the stock lose a sizeable portion of gains due to the release of OpenAI’s GPT-5 model, where a section of the demo introduced the AI’s capacity as a language learning to.

The dip provides a great opportunity to buy into Duolingo, given the sustained increase in users and paid subscribers. UBS analysts forecasts a target price of $500.

Leave a comment